What is PSLF?

Public Service Loan Forgiveness (PSLF) is a federal program that forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments (approximately 10 years) under a qualifying repayment plan while working full-time for an eligible public employer.

Upcoming Webinars

Upcoming Webinars

None at this time.

Past Webinars

Past Webinars

Public Service Loan Forgiveness (PSLF): Overview and Updates

Have you heard about the Public Service Loan Forgiveness (PSLF) program, but are not sure if you qualify? Do you want to learn more about how other student loan changes and updates impact PSLF?

In this webinar, you will get an overview of the PSLF program, including:

- Steps to apply and stay eligible for PSLF.

- Using Studentaid.gov to track your PSLF progress.

- The impact of ongoing SAVE litigation on PSLF.

- The PSLF Buyback program after the IDR Payment Count Adjustment.

You may also access the presentation slides and transcript.

Federal Student Loan Updates

Do you want to learn what is happening in the world of student loans right now? Do you have questions about the SAVE lawsuit and how it impacts your eligibility for forgiveness? In this webinar, you will get an overview of updates to federal student loan programs, including:

- The end of the "on-ramp" period on September 30, 2024.

- The end of the Fresh Start program to get out of default on September 30, 2024.

- SAVE litigation and options to remain eligible for Income-Driven Repayment (IDR) or Public Service Loan Forgiveness (PSLF).

- Overview of new Federal Student Loan Debt Relief.

You may also access the presentation slides and transcript.

Public Service Loan Forgiveness Q&A Session

Do you have lingering questions about the PSLF program? Are you confused about PSLF eligibility requirements? Are you unsure about how to start the PSLF process?

Join us for our new, open PSLF Q&A session where we will be answering your most burning questions about the program, live! We’ll start by addressing some of the most common PSLF questions, followed by live questions from attendees.

You may also access the presentation slides and transcript.

Public Service Loan Forgiveness (PSLF): New Regulations and Limited-Time Opportunities

Have you heard about the Public Service Loan Forgiveness (PSLF) program, but are not sure if you qualify? Do you want to know whether the new PSLF regulations could benefit you? In this webinar, you will get an overview of the PSLF program, including:

- Whether you may benefit from consolidating your loans before the new deadline, June 30, 2024, for the IDR Payment Adjustment.

- The new PSLF regulations that went into effect on July 1, 2023.

- IDR Payment Adjustment and how it may help you get PSLF credit for certain periods of forbearance, deferment, ineligible loans, or ineligible repayment plans.

- Steps to apply and stay eligible for PSLF.

You may also access the presentation slides and transcript.

Understanding the Income-Driven Repayment (IDR) Payment Adjustment

Last year, the Department of Education began implementing the IDR Payment Adjustment, leading to 18,350 Washingtonians being identified for forgiveness as of early November 2023. Between now and July 2024, more borrowers will continue to be identified for forgiveness or get closer to achieving forgiveness due to this limited-time opportunity!

The IDR Payment Adjustment can provide substantial retroactive credit towards a borrower’s 10 to 25-year Income-Driven Repayment (IDR) term. Watch this webinar to learn how you can benefit from IDR plans and this limited-time initiative, including:

- If you have never enrolled in an IDR plan before.

- If you recently enrolled in an IDR plan.

- If you are interested in learning how IDR plans may lead to student loan forgiveness.

- If you are interested in learning more about Income-Driven Repayment (IDR) plans, including the new the Saving on a Valuable Education (SAVE) plan.

- If you have FFEL or Perkins Loans, what steps you must take before April 30, 2024, to benefit.

You may also access the presentation slides and the transcript. For a quick overview of the IDR Payment Adjustment benefits and the steps you may need to take, check out our IDR Payment Count Adjustment Flyer.

Get Ready for Student Loan Repayment

Does the thought of restarting your federal student loan repayment on September 1, 2023, sound overwhelming to you? Are you confused by all the different repayment options available? Did you graduate during the payment pause and are not sure where to start with your student loans?

In this webinar, we discussed the steps you need to successfully navigate returning to student loan repayment. Watch our recorded webinar below lean more.

You may also access the presentation slides and transcript.

Stay Informed

Stay Informed

Sign up for email updates from the Student Loan Advocate to receive info about future webinars and other important PSLF news.

Contact the Student Loan Advocate

Contact the Student Loan Advocate

Check out the Office of the Student Loan Advocate website for:

- General resources and announcements about student loan topics:

- Income-driven repayment (IDR).

- Payment delinquency, default.

- Deferment and forbearance.

- Other loan forgiveness programs.

To ask questions about your loans (including PSLF and other types of forgiveness) or file a complaint, use the Washington State Student Complaint Portal.

Our Student Loan Advocate will be happy to help you.

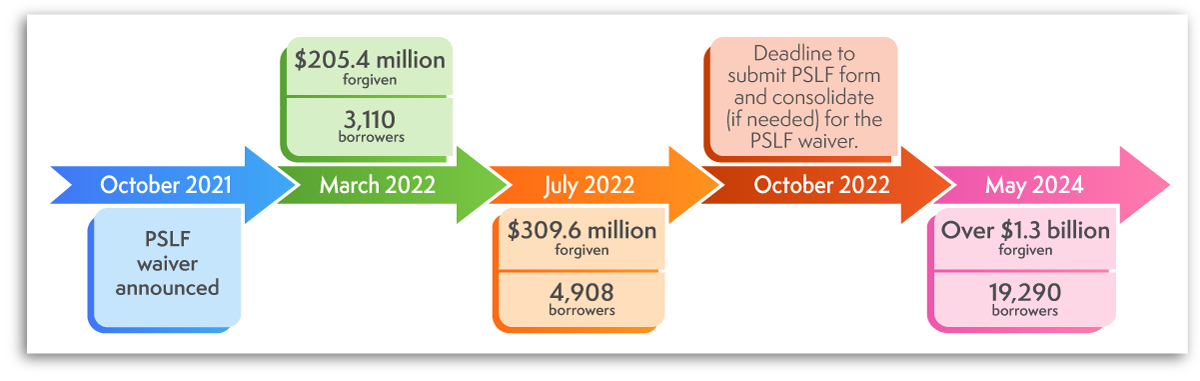

Timeline: PSLF outcomes for Washington borrowers

Use the tabs below to learn about the program rules, special opportunities to earn PSLF qualifying payments, and resources to navigate the PSLF process.

Normal PSLF Rules

Normal PSLF Rules

Borrowers who work an average of 30+ hours per week at a public service job could be eligible for debt forgiveness if they meet the requirements:

- Be employed by a U.S. federal, state, local, or tribal government or qualifying not-for-profit organization (federal service includes U.S. military service);

- Have Direct Loans (or consolidate other federal student loans into a Direct Loan);

- Repay your loans under an income-driven repayment plan or a 10-year Standard Repayment Plan; and

- Make a total of 120 qualifying monthly payments (about 10 years).

Learn more on Federal Student Aid’s Public Service Loan Forgiveness (PSLF) page.

Learn how to manage your Public Service Loan Forgiveness progress on StudentAid.gov.

IDR Account Adjustment – 2023-24

IDR Account Adjustment – 2023-24

In the past, there were a variety of reasons why some months may not have been credited toward Income-Driven Repayment (IDR) loan forgiveness and Public Service Loan Forgiveness (PSLF)—for example, months when you were in a payment plan that wasn’t eligible.

With this payment count adjustment, between now and September 2024, the U.S. Department of Education will change whether certain payments or months are credited toward your loan forgiveness. Borrowers with loans that have accumulated time in repayment of at least 20 or 25 years as a result of the adjustment will see automatic forgiveness, even if those borrowers are not currently on an IDR plan.

Want to learn more about how the Payment Adjustment may benefit PSLF applicants? Watch our webinar.

The payment count adjustment will count time toward IDR forgiveness, including:

- Any months in a repayment status, regardless of the payments made, loan type, or repayment plan;

- Twelve or more months of consecutive forbearance or 36 or more total months of forbearance;

- Any months spent in economic hardship or military deferments in 2013 or later;

- Any months spent in any deferment (with the exception of in-school deferment) prior to 2013; and

- Any time in repayment (or deferment or forbearance, if applicable) on earlier loans before consolidation of those loans into a consolidation loan.

Please note, repayment status does not include periods of in-school deferment, bankruptcy, or default.

We encourage borrowers who have commercially managed FFEL, Perkins, or Health Education Assistance Loan (HEAL) Program loans to apply for a Direct Consolidation Loan by June 30, 2024, if they want to receive the full benefits of the payment count adjustment. Consolidations submitted after June 30, 2024 may still benefit from the payment count adjustment, if the consolidation is completed when the IDR adjustment takes place in September 2024.

Effects on Public Service Loan Forgiveness (PSLF) Applicants:

- Borrowers with at least one approved PSLF form will begin to see their PSLF counts adjusted in Fall 2023.

- Borrowers who consolidate will have their PSLF counts temporarily reset to zero, and these counts will begin adjusting in Fall 2023.

- PSLF counts will continue to be adjusted each month until the IDR counts for all federally held FFELP and Direct Loans are adjusted in 2024.

- After the adjustment in 2024, all periods credited toward IDR will also be credited toward PSLF for eligible loans and periods where the borrower certifies public service employment.

- If you’ve applied or will apply for PSLF and certify your employment, you may see the benefits of this adjustment to your qualifying payment count.

- These changes will be applied automatically, to all PSLF-eligible Direct Loans, including consolidated and unconsolidated parent PLUS loans.

- If you believe you might benefit, use the PSLF Help Tool to certify periods of employment and track your progress toward forgiveness.

- Borrowers who have commercially or federally held FFEL loans and who apply to consolidate those loans into Direct Consolidation Loans by June 30, 2024, will also get PSLF credit under the payment count adjustment.

Learn more and read the Q&A on the Payment Count Adjustment page.

PSLF Waiver – 2022

PSLF Waiver – 2022

The Public Service Loan Forgiveness (PSLF) limited time waiver period ended on October 31, 2022. If you have any questions about the waiver, please submit a request.

On October 6, 2021, the U.S. Department of Education (ED) announced a new limited waiver opportunity for the PSLF program. For a limited time, borrowers could receive credit for past payments that had not previously qualified for PSLF.

Under this limited waiver opportunity, any prior payment made on a Federal Family Education Loan (FFEL), Federal Perkins Loan, or other non-direct federal student loan will count as a qualifying payment, regardless of repayment plan, or whether the payment was made in full or on time. All you needed was a qualifying employment and a Direct Loan. The waiver only applied to loans taken out by students, not parents.

In order to secure a review under the limited waiver opportunity, you may have needed to act by October 31, 2022. Please visit ED’s PSLF limited waiver opportunity webpage to find out what steps you needed to take, if any. For example:

- If borrowers had a loan type that does not normally qualify for PSLF, including a Federal Family Education Loan (FFEL) or Federal Perkins Loan, they needed to consolidate that loan into the Direct Loan program by October 31, 2022.

- If borrowers had not submitted a certification for all periods of qualifying employment, they needed to submit a PSLF form via the PSLF Help Tool for any uncertified employment period by October 31, 2022.

Direct Loan borrowers who had previously submitted certifications from their employers will receive automatic updates of their qualifying payment counts for the certified employment periods. However, it could take several months for these updates to appear.

Please note that Parent PLUS loans were not eligible for the limited waiver opportunity unless they were consolidated with loans from the parent’s own education.

PSLF and Direct Parent Plus Loans

PSLF and Direct Parent Plus Loans

Parent PLUS Loans are federal loans taken out by parents to help pay for their children’s education. Many Direct Parent PLUS borrowers ask us “Am I eligible for PSLF?” The answer is yes, but Direct Parent Plus borrowers face unique challenges when it comes to qualifying for forgiveness under the program.

Repayment Options for Parent PLUS loans

Direct Parent PLUS loans cannot be paid via an Income-Driven Repayment (IDR) plan, the repayment plans that are typically best for those pursuing PSLF. The only qualifying repayment option for Direct Parent PLUS loans is the 10-year Standard Plan, which may lead to no amounts forgiven at the end of the 120 qualifying payments for PSLF. In order to have a balance left to forgive under the 10-year Standard Plan, you will need to have at least some periods under eligible forbearance and deferment status (such as the COVID-19 administrative forbearance) while working at a qualifying public employer.

Consolidation to Access Income-Driven Repayment (IDR)

If you consolidate a Direct Parent PLUS loan (with a single consolidation), you may then repay the new Direct Consolidation Loan under an income-driven repayment plan called the Income-Contingent Repayment (ICR) Plan, which is the least generous of the IDR plans, requiring 20% of your discretionary income toward your monthly payment.

Typically, you can’t repay a Direct Consolidation Loan containing Parent PLUS loans under more affordable IDR options, like Saving on A Valuable Education (SAVE, previously known as REPAYE), Pay As You Earn (PAYE), or Income-Based Repayment (IBR) plans. However, there is a current double consolidation loophole that can give you access to all IDR plans, including SAVE. You can learn more about this loophole, including step-by-step instructions, on the Massachusetts Attorney General’s website. Please note, you must complete all the necessary consolidations by July 1, 2025, to access other IDR plans besides Income-Contingent Repayment (ICR).

You can use the Loan Simulator to help you decide whether to consolidate your student loans and estimate your monthly payment under different IDRs. The Loan Simulator uses your actual loan information (if you log in with your FSA ID) to give you a more accurate estimate of your loan payments.

Tips about Consolidation:

- Direct Consolidation Loans need to be consolidated with another loan.

- FFEL Consolidation Loans can be consolidated into the Direct Loan Program even if you do not have another loan to consolidate.

- Direct or FFEL Parent PLUS loans can be consolidated even if you do not have another loan to consolidate.

How do I apply for PSLF?

Use the tabs below to learn more about the PSLF process and the steps you need to take to receive forgiveness under the program.

Quick PSLF Overview

Quick PSLF Overview

For a quick, easy to understand explanation of the program, please check out the How to Get your Student Loans Forgiven (No, Really) handout.

Steps to Apply for PSLF

Steps to Apply for PSLF

Do you want to apply for PSLF but don’t know where to start? Check out the Steps to Apply for PSLF for step-by-step guidance on how to apply and remain eligible for PSLF.

PSLF Frequently Asked Questions

PSLF Frequently Asked Questions

Do you have general questions about the PSLF program? Check out the Public Service Loan Forgiveness (PSLF) FAQs to find answers to the most frequently asked questions about the program.

Information for Employers

Information for Washington State Agencies and Public Institutions of Higher Education

In March 2022, in response to the student loan debt crisis facing the country, the state Legislature passed legislation to raise awareness and remove barriers for public service employees to access the PSLF program with specific requirements for Washington state agencies and public institutions of higher education (ESSB 5847, codified as RCW 28B.77.009, RCW 43.41.425, RCW 41.04.045, and RCW 41.04.055).

Office of Financial Management (OFM) created a webpage and HR portal to provide guidance to Washington state agencies and public institutions of higher education on how to comply to the new regulations.

Information for Local Municipalities and Nonprofit Organizations

Local government agencies, like cities, counties, tribal government, and nonprofits are a significant part of the public sector workforce. You as an employer play an essential role in helping borrowers receive Public Service Loan Forgiveness (PSLF). Do you want to help your employees benefit from PSLF, but are not sure how?

As part of our efforts to make the certification process easier for local government agencies and qualifying nonprofit organizations located in Washington state, we have created in partnership with the Office of Financial Management (OFM), the following notice templates you can use to support your employees on their path toward loan forgiveness:

- PSLF Notice for New Employees. We recommend sharing this letter (web or print version) with employees upon hiring, during the onboarding process to introduce the PSLF program and process.

- PSLF Annual Notice. We recommend sharing this letter (web or print version) with employees on an annual basis and any time PSLF regulations change (see below) to continue raising awareness of the program and the resources available.

- PSLF Notice for Separated Employees. We recommend sharing this letter (web or print version) with employees during the separation process, so they know which steps to take to receive and potentially continue receiving PSLF credit.

PSLF program regulations may change from time to time. We will periodically update the letters to reflect the most up-to-date PSLF rules. If you would like to receive updates when these materials are updated, please join our mailing list.

We’re here to assist PSLF employers! If you have any questions about the PSLF process as an employer, please send your question(s) to PSLF@ofm.wa.gov.

Additional Resources:

- Check out detailed guidance on which nonprofit organizations qualify for PSLF.

- Check out Federal Student Aid’s employer tips on tacking the PSLF form

- Check out Federal Student Aid’s guidance on the employer’s role in PSLF

- Check out step-by-step instructions on how to use the PSLF Help Tool DocuSign feature as an employer

- Find out the acceptable signature methods on manual PSLF Forms.

PSLF Employer Resources & Tips - WACO Presentation

Between March 2022 and March 2024, 19,220 public service employees in Washington state have received a total of $1.298 billion dollars in federal student loan forgiveness through the PSLF program.

PSLF is a federal program that forgives the remaining balance on Direct Loans for public service employees. Learn how you can use PSLF as a no-cost tool to recruit and retain your employees. In this webinar, we’ll cover:

- An overview of the PSLF program

- PSLF resources for employers and employees

- How public service employers can help employees access PSLF

- How the Office of the Student Loan Advocate can support employees on their path to forgiveness

You may also access the presentation slides and transcript.

Information for Washington State Employees

Washington State Directory for PSLF Contacts

If you are completing your PSLF form and need to find your current or former agency's Employer Identification Number (EIN) or HR contact information, refer to Washington state agency directory of PSLF contacts.

The directory includes Employer Identification Numbers (EINs) and HR email addresses for each agency, which are required for employees to complete the PSLF form on the PSLF Help Tool.

Part-time Academic Employees Full-time Calculation

Are you a part-time academic employee (commonly known as “adjunct faculty”) at a public institution of higher education? Did you know that according to RCW 41.04.055, your human resources department at public institutions of higher education must multiply part-time faculty’s in-class teaching hours by 3.35 to calculate your hours worked for the PSLF form? This is to account for duties performed in support of, or in addition to, contractually assigned in-class teaching hours.

Your human resources department may apply this calculation retroactively to figure out whether the U.S. Department of Education considers a part-time academic employee “full time” for the PSLF form. Please note that this calculation does not supersede any calculation or adjustment set up in the collective bargaining agreements or higher education institution policies.

SAVE Litigation Impacting PSLF

SAVE Litigation Impacting PSLF

Public Service Loan Forgiveness (PSLF) requires borrowers to be on an income-driven repayment (IDR) plan (or the 10-year standard repayment plan). Since the return to repayment in 2023, many student loan borrowers seeking PSLF opted into the SAVE IDR plan that offered more generous benefits.

- In summer 2024 a federal court blocked the U.S. Department of Education (ED) from implementing parts of the Saving on a Valuable Education (SAVE) Plan and other IDR plans. Here’s what it means for borrowers:

- Forbearance: Borrowers enrolled in SAVE are being moved to a 0% interest forbearance while the case is decided. Borrowers will not need to make payments during the forbearance. The time in forbearance will not count towards Public Service Loan Forgiveness or Income-Driven Repayment (IDR) forgiveness. Learn what options you have to get PSLF or IDR credit during this time.

- Online IDR and Consolidation Applications are temporarily unavailable. You may still complete both applications by submitting a PDF/paper application. Servicers have temporarily paused processing of IDR applications until ED can ensure applications are processed correctly. Borrowers should expect a lengthy delay in processing of applications.

- Check out ED’s updates on the SAVE plan and Student Loan Borrower Q&A for additional information including:

- Options for enrolling in SAVE or changing to another IDR plan.

- How you can still earn PSLF credit by changing repayment plans and/or utilizing PSLF Buy Back.

About the student loan advocate

The student loan advocate has independent statutory authority to analyze and monitor laws and policies that impact student loan borrowers at the federal, state, and local level, and to make recommendations. The student loan advocate also works directly with loan borrowers to address complaints and help them navigate issues and identify resources.

Skip to main content

Skip to main content